- 分析

- 市場匯評

美聯儲降息與AI下一波浪潮:低利率將如何推動科技繁榮 - 12.8

今日市场总结

- 美聯儲降息預期令美元指數承壓

- 比特幣飆升至近90,000美元水平

- 全球股市本週表現強勁

- 布倫特原油和WTI原油均上漲

- 黃金價格延續了令人矚目的長期看漲趨勢

每日最熱新聞

本週最重要的新聞圍繞市場對美聯儲下週降息的預期展開。美聯儲很可能將連續第三次降息。另一則次要但同樣重要的消息是人工智能相關投資的持續繁榮,這幫助科技板塊在全球範圍內表現出強勁的上漲。然而,這種增長背後隱藏著對頑固通膨和美國創紀錄財政赤字可持續性的擔憂。

外匯新聞

美聯儲降息預期令美元指數承壓,使其從關鍵支撐區域回落。交易員正在積極消化美元疲軟的預期,不過由於市場等待美聯儲的官方聲明和前瞻指引,下行勢頭暫時受到遏制。

歐元/美元和英鎊/美元:這兩組貨幣對相對於走軟的美元均表現強勢。分析師特別指出,英鎊/美元是押注美元走弱時的首選市場,顯示出更清晰的高點更高、低點更高的模式,並向上突破至1.3350附近的重要阻力區域。歐元/美元也顯示出看漲信號,守在一個關鍵水平之上,但其趨勢不如英鎊明確。

美元/日元:本週該貨幣對出現回調,主要原因是市場猜測日本央行(BoJ)可能在本月晚些時候發出升息信號。這導致日元走強,打破了其通常與美債收益率的關聯。美元/日元正進入關鍵一週,市場焦點分佈在美聯儲的決議和日本央行潛在的政策轉變之間。

澳元/美元:澳元已大幅走高接近阻力位,受益於普遍走軟的美元,但分析師警告稱,在急劇上漲後,動能衰竭的風險可能正在積聚。

股市新聞

| 澳大利亞股指 | --- | --- | --- |

| Dow Jones Industrial Average (30), 股票指數 | --- | --- | --- |

| 英國股票指數 | --- | --- | --- |

| Nasdaq (100), 股票指數 | --- | --- | --- |

| Nikkei (225), 股票指數 | --- | --- | --- |

| Standard & Poor’s (500), 股票指數 | --- | --- | --- |

全球股市本週表現強勁,這主要基於對利率下降的樂觀預期以及人工智能主題的再度興起。

道瓊斯指數、納斯達克指數和標準普爾500指數:美國主要股指持續交易於歷史高位附近。標準普爾500指數和納斯達克指數領漲,科技股反彈,印證了市場對人工智能相關公司的濃厚興趣。道瓊斯指數也錄得穩健漲幅,反映出廣泛的市場信心。

日經指數大幅上漲,攀升超2%,接近其自身的歷史高點。這主要受到全球降息預期的推動,儘管日本央行可能升息帶來了一些不確定性。

恆生指數逆轉了早前的跌勢,本週收於正區間,漲幅主要集中在科技和消費板塊。

澳大利亞股指本週小幅收漲,從早前的下跌中恢復。板塊表現分化,材料和能源股領漲,而房地產和必需消費品板塊則表現落後。

商品市場新聞

黃金市場新聞

| 黃金 | --- | --- | --- |

黃金價格延續了令人矚目的長期看漲趨勢,XAUUSD(現貨黃金)價格保持強勢。黃金一直交易於近期高點附近,測試上方阻力帶。黃金走強的主要驅動力是美元走弱以及市場普遍認為美聯儲即將降息。黃金作為避險資產的角色,加上各國央行的黃金購買熱潮以及持續的地緣政治不穩定,已深刻重塑了其價值,一些分析師認為過去一年黃金出現了大幅上漲行情。然而,短期內,黃金價格在消化近期漲幅後進入溫和修正階段,目前正在4200水準附近的關鍵支撐區域上方盤整。

美元指數 新聞

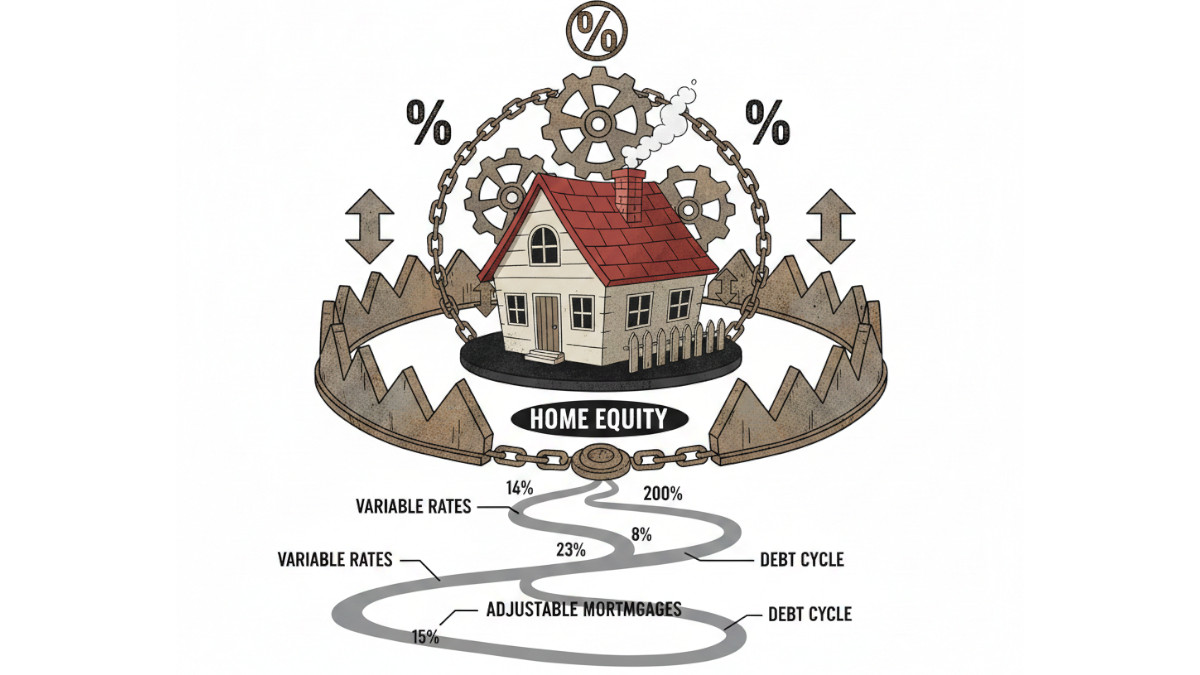

善意鋪就地獄之路:全國信用卡利率上限設定為10%的提案

自2026年1月起,一項提案擬將全國信用卡利率上限設定為10%。初衷是幫助負債累累的美國人。但借貸的實際運作十分複雜,數據顯示該上限可能導致意想不到的後果,最終傷害本應受助的人群。...

穩定幣超級週期 - 對傳統銀行業的威脅

穩定幣的崛起可能會改變全球金融的運作方式。從市值約2000億美元起步,它有望發展成一個數萬億美元的系統,並成為日常金融活動的核心部分。...

美元走軟 受美政府停擺風險與非農業資料延遲拖累

美元走軟,原因是市場對兩件事態發展做出了反應:聯邦政府可能關門,以及美國勞動力市場數據的延遲發布。這兩件事都很重要,因為它們都增加了市場和政策決策的不確定性。美元為何波動美元下跌被各大頭條歸結為對政府停擺擔憂的反應。當國會未能在資金耗盡前通過預算或臨時支出法案時,政府就會停擺。這項爭議焦點在於是否要納入對醫療保健計畫的保護—《平價醫療法案》補貼和醫療補助計畫資金。民主黨堅持納入這些條款,共和黨則希望通過無附加條款的純粹支出法案。這一分歧使得政府停擺成為現實可能。另據消息,若政府停擺,美國勞工統計局可能延後發布就業報告。這些數據對市場至關重要,因為就業數據是聯準會制定政策和市場預期的重要依據。資料缺失或延遲將加劇不確定性,通常會導緻美元短期走弱。數據揭示的真相美元指數的價格走勢顯示這只是溫和回落,而非崩盤。該指數仍接近近期高點。交易員正在謹慎調整頭寸,而非對美元走強的根本結構變化作出反應。此次回檔更多是不確定性驅動的暫歇,並非趨勢逆轉。政府停擺的可能性是政治博弈的結果。圍繞醫療保健撥款的爭議為雙方都提供了談判籌碼。從民主黨視角看:將醫療保健保護條款納入預算是其政策優先事項。從共和黨立場看:堅持通過無附加條款的法案是控制預算先例的手段。這兩種立場既是政策主張,更是政治策略的體現。注意要點短期來看:若政府停擺威脅消退,美元可能迅速重拾漲勢。若停擺發生並導致就業數據延遲,市場波動性預計將加劇。中期而言:市場將聚焦於勞動力數據何時恢復發布及其具體內容。美元走勢將取決於聯準會對通膨和就業成長的判斷——是否符合進一步收緊或放鬆貨幣政策的條件。核心要点...

如何在新闻发布时进行外汇交易

为什么新闻会影响外汇市场。在外汇市场中,价格波动源于新信息,更确切地说,是经济新闻。通胀、就业、利率或贸易平衡等方面的报告会改变投资者对一个国家经济状况的看法。这进而影响他们对该国货币价值的评估。外汇市场几乎全天候运行(从周日晚上5点至周五晚上5点,东部时间)。这意味着几乎任何主要国家的经济新闻都可能影响价格,无论白天还是夜晚...

美联储的沃勒:需要尽快降息

美联储理事克里斯·沃勒表示,现在是美联储降息的时候了。在最近的一次采访中,他警告称,美国劳动力市场正显示出隐性疲软迹象,尤其是在私营部门。沃勒表示,他可能在7月下次美联储会议上投票反对维持利率不变,但他补充说,他尽量不经常反对。...