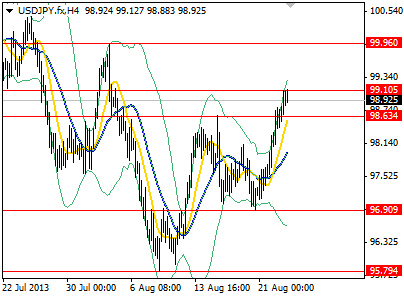

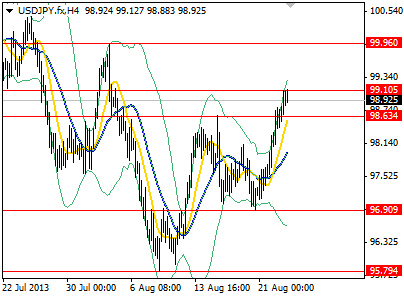

The Japanese Yen weakened further against its major counterparts as stronger PMI data from China, Europe and US suggested that expansion prevails in global economy lifting risk appetite, thus investors abandoned the safety of the Yen. Furthermore, US 10 year treasury yields rose to new high at 2.89% indicating that investors move their money out of bond markets to riskier assets as asset tapering expectation is growing among market participants. All that underpinned US equities last night followed by NIKKEI 225 that close higher by 2.21%, helping USDJPY to breach resistance at 98.63 yesterday and surging earlier today to 99.10.

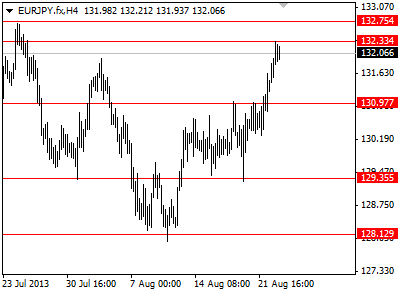

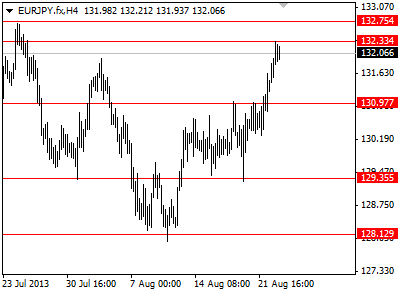

In addition, the EURJPY penetrated the resistance at 130.97 yesterday and rose to 132.33 as Japanese Yen was weakening further. Yen crosses bias is turning bullish on recent data as well as on speculation that Haruhiko Kuroda BOJ governor could take further stimulus measures because inflation is still well below target and growth was less than projected in the 2nd quarter. We consider though the

USDJPY is overextended and near major resistance at 100 in the intraday with the EURJPY also close to top of the longer term range at 132.75. Thus we are cautious that pairs may consolidate in the immediate term but next week fundamentals could drive them above their upside limitations.

Elsewhere, we saw the

EURUSD bouncing up to 1.3371 from 1.3297 on profit taking as the US Jobless Claims were disappointing inducing the greenback to make a correction. Early today final GDP figure for Germany confirmed growth and we expect the EURUSD to consolidate between 1.3371/1.3343 tight zone, because both currencies’ fundamentals are supportive. Aussie pulled back to resistance at 0.9044 yesterday on Chinese PMI and is consolidating currently near 0.90.

USDCAD strongly advanced from 1.0358 to 1.0542 most likely to go up to 1.0604 before we see some profit taking. Main events today are 2nd estimate UK GDP, CPI figures for Canada, US New Home Sales and Jackson Hall Symposium second day.