- 分析

- 領漲/跌者

Top Gainers and Losers: Tesla Motors and DASH

Top Gainers - Global Market

Top Gainers - Global Market

Over the past 7 days, the US dollar index has remained largely unchanged. It has been trading in a narrow range of 103.2-104.4 points for the 4th week in a row. Investors are awaiting the outcome of the Federal Reserve meeting on June 14. Tesla shares have risen due to the opening of new gigafactories and the news that General Motors and Ford may use its Supercharger network for their electric vehicles. The South African rand has strengthened due to positive economic indicators. South Africa's Gross Domestic Product grew by +0.2% YoY in the first quarter of 2023, contrary to expectations of a decline of more than 2%. Cryptocurrencies have declined following claims by the U.S. Securities and Exchange Commission against the activities of crypto exchanges Binance and Coinbase.

1. Tesla Motors Inc., +14.2% – American electric vehicle manufacturer

2. IHI Corporation, +13.1% – Japanese manufacturer of aviation and marine engines

Top Losers - Global Market

Top Losers - Global Market

1. DASH (DSH) – cryptocurrency

2. Cardano (ADA) – cryptocurrency

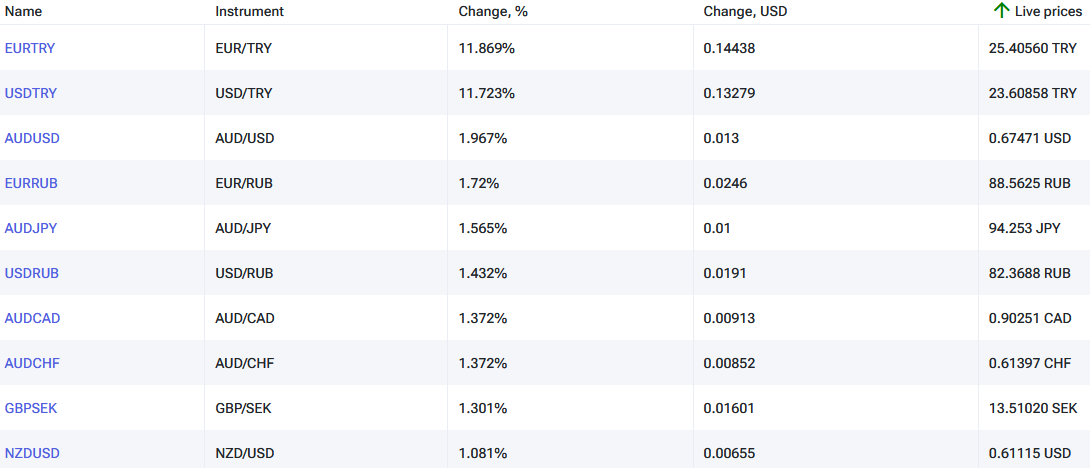

Top Gainers - Forex Market

Top Gainers - Forex Market

1. EURTRY, USDTRY - an increase in these charts indicates the strengthening of the euro and the US dollar against the Turkish lira.

2. AUDUSD, AUDJPY - an increase in these charts indicates the weakening of the US dollar and the Japanese yen against the Australian dollar.

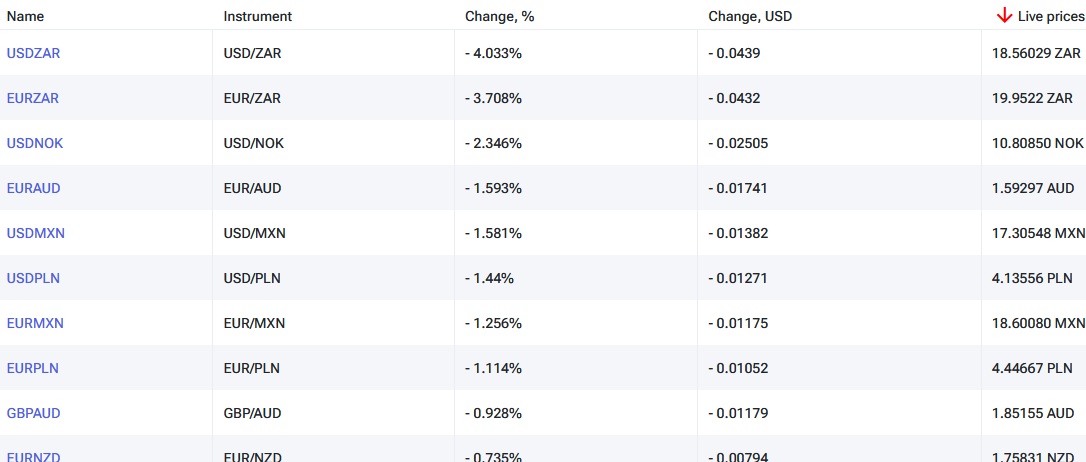

Top Losers - Forex Market

Top Losers - Forex Market

1. USDZAR, EURZAR - a decrease in these charts indicates the weakening of the US dollar and the euro against the South African rand.

2. USDNOK, EURAUD - a decrease in these charts indicates the strengthening of the Norwegian krone against the US dollar and the Australian dollar against the euro.

附注:

本文針對宣傳和教育, 是免費讀物. 文中所包含的資訊來自於公共管道. 不保障資訊的完整性和準確性. 部分文章不會更新. 所有的資訊, 包括觀點, 指數, 圖表等等僅用於介紹, 不能用於財務意見和建議. 所有的文字以及圖表不能作為交易的建議. IFC Markets及員工在任何情況下不會對讀者在閱讀文章中或之後採取的行為負責.

過往的贏家和輸家

Over the past 7 days, the American dollar has remained almost unchanged. According to the CME FedWatch tool, there is an 89% probability of the U.S. Federal Reserve raising interest rates at the meeting on July 26th. The Swiss franc has strengthened due to positive economic indicators such as Credit...

Over the past 7 days, the US dollar index has declined. As expected, the Federal Reserve (Fed) maintained its interest rate at 5.25% during the meeting on June 14. Now, investors are monitoring economic statistics and trying to forecast the change in the Fed's rate at the next meeting on July 26. The...

Over the past 7 days, the US dollar index has remained almost unchanged. After the publication of economic statistics and statements by Federal Reserve representatives, investors believe that the Fed will maintain the interest rate at the current level of 5.25% at the upcoming meeting on June 14. The...