- 分析

- 技術分析

白銀對日元 技術分析 - 白銀對日元 交易: 2018-04-04

Let us consider a new personal composite instrument

In this review, we suggest considering the personal composite instrument (PCI) XAGJPY – Silver vs the Japanese Yen. As its name suggests, it reflects the price dynamics of silver vs the yen. Will the XAGJPY prices rise?

Their growth indicates an increase in silver prices and a weakening of the Japanese yen. Precious metals prices may rise amid global risks because of the US-China trade war. Silver has lagged behind the gold since early 2018. In turn, the weakening of the yen may be caused by the preservation of the super-loose monetary policy of the Bank of Japan. This is contributed by the low inflation in the country. On Friday, April 6, 2018, data on the labor market for March will come out in the US. They can affect the world currency market and, in particular, the exchange rate of the yen. In Japan, the most significant statistics are expected on Monday, April 9, when the current account balance for February will be released. Less important Japanese economic data will be published this week.

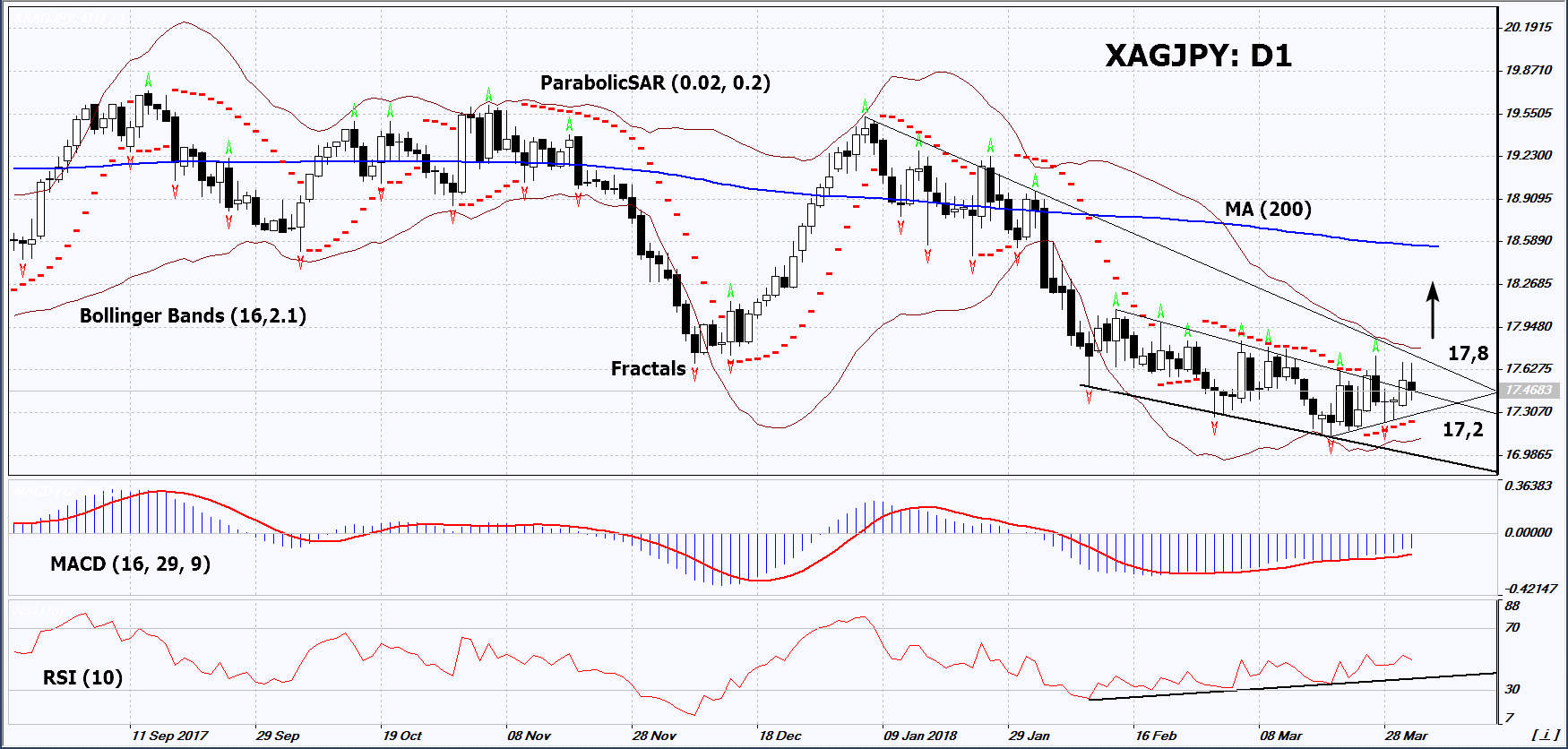

On the daily timeframe, XAGJPY: D1 is trying to edge up from the downtrend. The further price increase is possible in case of increasing global political risks and economic uncertainty, as well as in case of the publication of negative economic data in Japan.

- The Parabolic indicator gives a bullish signal.

- The Bollinger bands have narrowed, which indicates low volatility. They are titled upward.

- The RSI indicator is near 50. It has formed a positive divergence.

- The MACD indicator gives a bullish signal.

The bullish momentum may develop in case XAGJPY exceeds the last fractal high and the Bollinger band at 17.8. This level may serve as an entry point. The initial stop loss may be placed below the last fractal low and the Parabolic signal at 17.2. After opening the pending order, we shall move the stop to the next fractal low following the Bollinger and Parabolic signals. Thus, we are changing the potential profit/loss to the breakeven point. More risk-averse traders may switch to the 4-hour chart after the trade and place there a stop loss moving it in the direction of the trade. If the price meets the stop level at 17.2 without reaching the order at 17.8 we recommend to close the position: the market sustains internal changes that were not taken into account.

Summary of technical analysis

| Position | Buy |

| Buy stop | Above 17,8 |

| Stop loss | Below 17,2 |

附注:

本文針對宣傳和教育, 是免費讀物. 文中所包含的資訊來自於公共管道. 不保障資訊的完整性和準確性. 部分文章不會更新. 所有的資訊, 包括觀點, 指數, 圖表等等僅用於介紹, 不能用於財務意見和建議. 所有的文字以及圖表不能作為交易的建議. IFC Markets及員工在任何情況下不會對讀者在閱讀文章中或之後採取的行為負責.