- 分析

- 技術分析

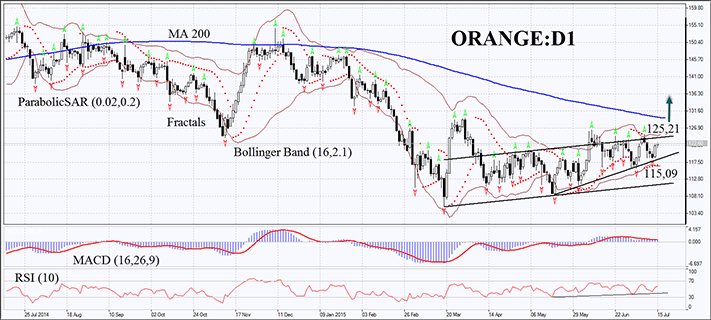

橙汁 技術分析 - 橙汁 交易: 2015-07-15

Agricultural departmet cut orange crops forecast

In this overview we would like to go back to the continuous ORANGE juice CFD. In mid-May the price dropped to the 3-year low but did not manage to breach it and since then have been moving up slowly. The uptrend accelerated at the beginning of the summer season with the rising demand for refreshing drinks. Last week US Department of Agriculture lowered forecast for orange crops in the season 2014/2015 from 155.87 mln to 148.58mln boxes. To be noted, the crops were close to their minimum in the previous four seasons and may be even lower. Meanwhile, the orange juice price did not increase and is balancing near the level of 2012. We believe it to be a result of decreasing import by China, seen at the beginning of the year. Besides, the demand for orange juice has lately been contracting in the US due to growing popularity of energy drinks.

On the daily chart the ORANGE:D1 CFD is traded in an uptrend below the 200-day Moving Average. Bollinger Bands are still narrow, indicating low volatility. MACD bars have a very small amplitude and do not give any apparent signals, while Parabolic has been forming buy signals. The ascending RSI-Bars indicator crossed the 50-point level. There is no sign of divergence. The bullish movement may continue if another ORANGE CFD bar closes above the upper Bollinger band, the channel boundary and the latest fractal high at 125.21. A stop loss may be placed below the first Parabolic signal, the Bollinger band and the trend support line at 115.9. After pending order activation the stop loss is supposed to be moved every four hours near the next fractal low, following Bollinger and Parabolic signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. The most cautious traders may switch to the H4 time frame and place a stop loss, moving it after the trend. If the price reaches the stop loss without triggering the order we recommend to cancel the position: the market sustains internal changes that were not considered.

| Position | Buy |

| Buy stop | above 125.21 |

| Stop loss | below 115.9 |

附注:

本文針對宣傳和教育, 是免費讀物. 文中所包含的資訊來自於公共管道. 不保障資訊的完整性和準確性. 部分文章不會更新. 所有的資訊, 包括觀點, 指數, 圖表等等僅用於介紹, 不能用於財務意見和建議. 所有的文字以及圖表不能作為交易的建議. IFC Markets及員工在任何情況下不會對讀者在閱讀文章中或之後採取的行為負責.