- 分析

- 技術分析

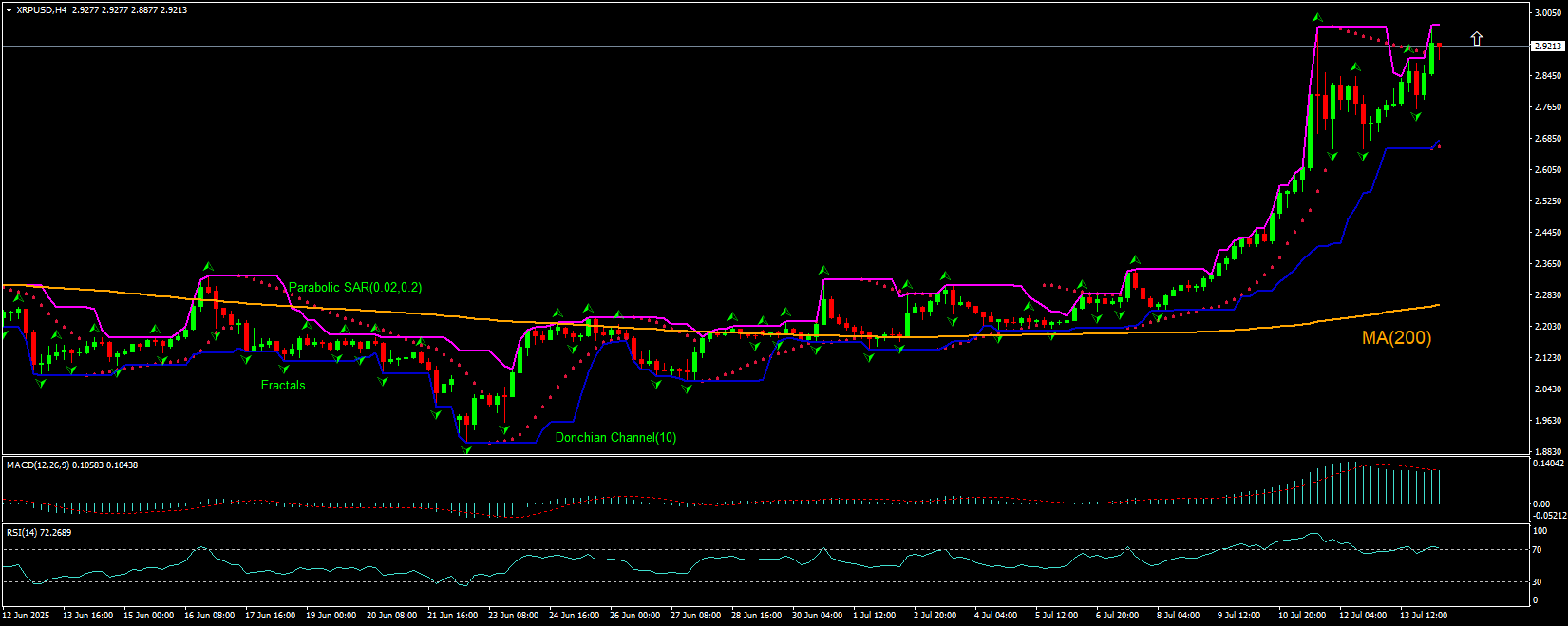

XRPUSD 技術分析 - XRPUSD 交易: 2025-07-14

XRPUSD 技術分析總結

高於 2.9751

Buy Stop

低於 2.7608

Stop Loss

| 指標 | 信號 |

| RSI | 賣出 |

| MACD | 中和 |

| Donchian Channel | 買進 |

| MA(200) | 買進 |

| Fractals | 買進 |

| Parabolic SAR | 買進 |

XRPUSD 圖表分析

XRPUSD 技術分析

XRPUSD 4小时价格图表的技术分析显示,XRPUSD 在H4时间框架下,在三天前反弹至4个月高点后回调走低,目前正突破200日移动平均线(MA(200))向上行进。相对强弱指数(RSI)指标处于超买区域。 我们认为,当价格突破Donchian通道上轨2.9751后,看涨动能将持续。该水平上方可作为挂单买入的入场点。止损位可设置在2.7608下方。下单后,止损位需跟随抛物线指标信号移动至下一个分形低点。因此,我们将预期盈亏比调整至盈亏平衡点。若价格触及止损位但未达到订单价格,建议取消订单:市场已发生未被考虑的内部变化。

加密貨幣 基本面分析 - XRPUSD

知名软件开发者文森特·范·科德(Vincent Van Code)声称,SWIFT可能很快会宣布其计划,将XRP和Ripple作为银行间支付的替代结算层。XRPUSD价格是否会继续上涨?

SWIFT凭借其覆盖超过11,000家成员机构的庞大网络,已成为跨行通信的行业标准。当前全球支付基础设施的低效问题可通过SWIFT与Ripple的战略合作解决,尤其是整合XRP的方案。作为区块链技术倡导者的文森特·范·科德(Vincent Van Code)暗示,SWIFT可能很快宣布计划采用XRP和Ripple作为银行间支付的替代结算层。RippleNet与按需流动性(ODL)已推出基于区块链的实时解决方案。对于试图提升资本效率并降低运营摩擦的金融机构而言,ODL解决方案极具吸引力,因为它消除了对昂贵nostro/vostro账户的需求。过去,Ripple曾承认与SWIFT及其不断扩大的合作伙伴网络(包括中央银行)进行过对话。将XRP作为银行间支付的替代结算层的潜在应用,对XRPUSD而言是利好消息。

附注:

本文針對宣傳和教育, 是免費讀物. 文中所包含的資訊來自於公共管道. 不保障資訊的完整性和準確性. 部分文章不會更新. 所有的資訊, 包括觀點, 指數, 圖表等等僅用於介紹, 不能用於財務意見和建議. 所有的文字以及圖表不能作為交易的建議. IFC Markets及員工在任何情況下不會對讀者在閱讀文章中或之後採取的行為負責.