- 分析

- 技術分析

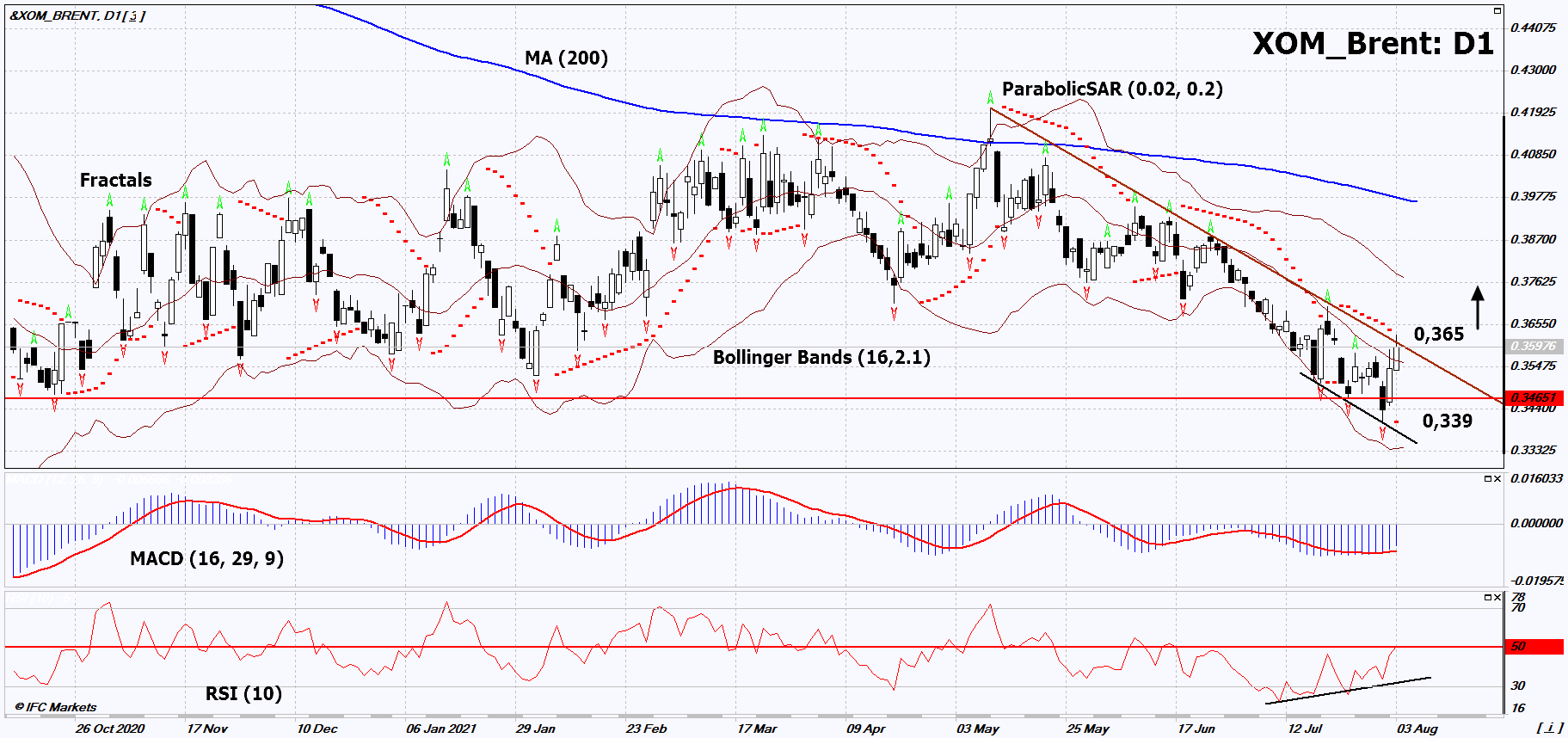

Exxon Mobil 股票對Brent 技術分析 - Exxon Mobil 股票對Brent 交易: 2021-08-04

Exxon Mobil 股票對Brent 技術分析總結

高於 0.365

Buy Stop

低於 0.339

Stop Loss

| 指標 | 信號 |

| RSI | 買進 |

| MACD | 買進 |

| MA(200) | 中和 |

| Fractals | 中和 |

| Parabolic SAR | 買進 |

| Bollinger Bands | 中和 |

Exxon Mobil 股票對Brent 圖表分析

Exxon Mobil 股票對Brent 技術分析

On the daily timeframe, XOM_Brent: D1 approached the downtrend resistance line. It must be broken upward before opening a position. A number of technical analysis indicators have generated signals for further growth. We do not rule out a bullish movement if XOM_Brent rises above its last high: 0.365. This level can be used as an entry point. Initial risk limitation is possible below the Parabolic signal, the low since October 2013 and the last down fractal: 0.339. After opening a pending order, move the stop to the next fractal low following the Bollinger and Parabolic signals. Thus, we change the potential profit / loss ratio in our favor. The most cautious traders, after making a deal, can go to the four-hour chart and set a stop-loss, moving it in the direction of movement. If the price overcomes the stop level (0.365) without activating the order (0.339), it is recommended to delete the order: there are internal changes in the market that were not taken into account.

PCI 基本面分析 - Exxon Mobil 股票對Brent

In this review, we suggest looking at the XOM_Brent personal composite tool (PCI). It reflects the price action of the shares of the American oil company Exxon Mobil Corporation against the deliverable futures for Brent crude oil. Will the XOM_Brent quotes rise?

The growth of this PCI means that Exxon Mobil shares are appreciating faster than oil. The company's 2Q2021 financials were better than expected. Earnings per share amounted to $ 1.1 against the forecast of $ 0.97. The total profit was $ 4.7 billion. In the 2nd quarter of 2020, the financial result was much worse. The loss per share was $ 0.26, and the total loss was $ 1.1 billion. Exxon Mobil's revenues in the 2nd quarter of 2021 reached $ 67.7 billion and exceeded the forecast of $ 65 billion. the current share price is about 6% per annum. In turn, oil quotes are now declining amid an increase in the number of patients with the new strain of the Delta coronavirus in the United States and China. This can reduce the demand for fuel. Also, expectations of a new round of talks between Iran and Western countries on easing sanctions and the "nuclear deal" have a negative impact on the price of oil. Earlier, Iran was going to increase oil production by 1.5 million barrels per day if the sanctions were lifted.

附注:

本文針對宣傳和教育, 是免費讀物. 文中所包含的資訊來自於公共管道. 不保障資訊的完整性和準確性. 部分文章不會更新. 所有的資訊, 包括觀點, 指數, 圖表等等僅用於介紹, 不能用於財務意見和建議. 所有的文字以及圖表不能作為交易的建議. IFC Markets及員工在任何情況下不會對讀者在閱讀文章中或之後採取的行為負責.