- 分析

- 技術分析

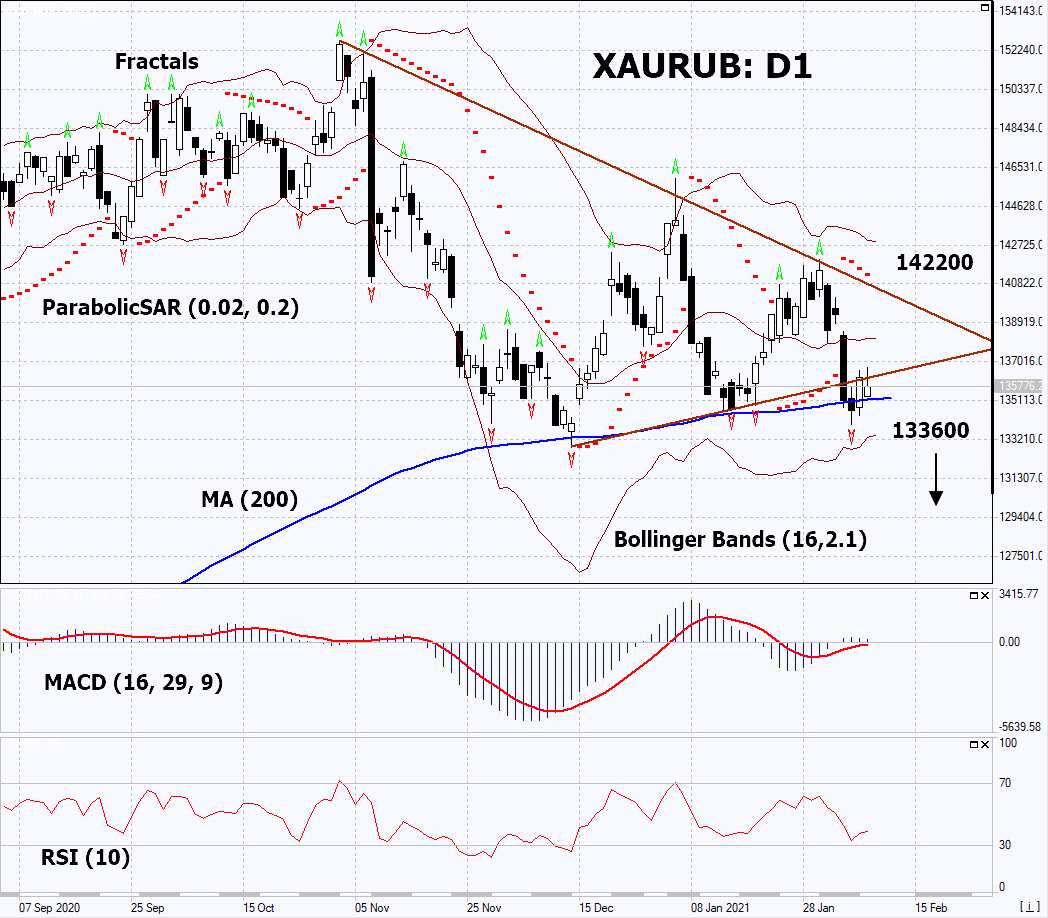

黃金對俄羅斯盧布 技術分析 - 黃金對俄羅斯盧布 交易: 2021-02-10

黃金對盧布 技術分析總結

低於 133600

Sell Stop

高於 142200

Stop Loss

| 指標 | 信號 |

| RSI | 中和 |

| MACD | 中和 |

| MA(200) | 中和 |

| Fractals | 中和 |

| Parabolic SAR | 賣出 |

| Bollinger Bands | 中和 |

黃金對盧布 圖表分析

黃金對盧布 技術分析

On the daily timeframe, XAURUB: D1 broke down the uptrend support line and went down from the triangle. A number of technical analysis indicators formed signals for a further drop, despite the fact that in the last 2 days there has been a slight increase and a return to the broken trend line. We do not rule out a bearish movement if XAURUB falls below its last lower fractal and 200-day moving average line: 133600. This level can be used as an entry point. We can place a stop loss above the last upper fractal and Parabolic signal: 142200. After opening a pending order, we can move the stop loss following the Bollinger and Parabolic signals to the next fractal maximum. Thus, we change the potential profit/loss ratio in our favor. After the transaction, the most risk-averse traders can switch to the four-hour chart and set a stop loss, moving it in the direction of the bias. If the price meets the stop loss (142200) without activating the order (133600), it is recommended to delete the order: the market sustains internal changes that are usually not taken into account.

PCI 基本面分析 - 黃金對盧布

In this review, we propose to consider the &XAURUB Personal Composite Instrument (PCI). It reflects the changes in the value of gold against the Russian ruble. Will the XAURUB quotes downgrade?

The downward tendency means a slump in gold prices denominated in Russian rubles. Precious metals prices may stabilize during the Chinese New Year. Chinese people will get 7 days off on February 11-17 this year. The gold dynamics may be affected by the US inflation data due out on February 10, and the speech of the Federal Reserve Chair Jerome Powell. The Russian ruble may grow amid rising world oil prices. Hydrocarbons account for about 70% of Russian exports. Against this background, Morgan Stanley Bank announced an increase in investments in the ruble. Other Western investors are likely to join it.

附注:

本文針對宣傳和教育, 是免費讀物. 文中所包含的資訊來自於公共管道. 不保障資訊的完整性和準確性. 部分文章不會更新. 所有的資訊, 包括觀點, 指數, 圖表等等僅用於介紹, 不能用於財務意見和建議. 所有的文字以及圖表不能作為交易的建議. IFC Markets及員工在任何情況下不會對讀者在閱讀文章中或之後採取的行為負責.