- 分析

- 技術分析

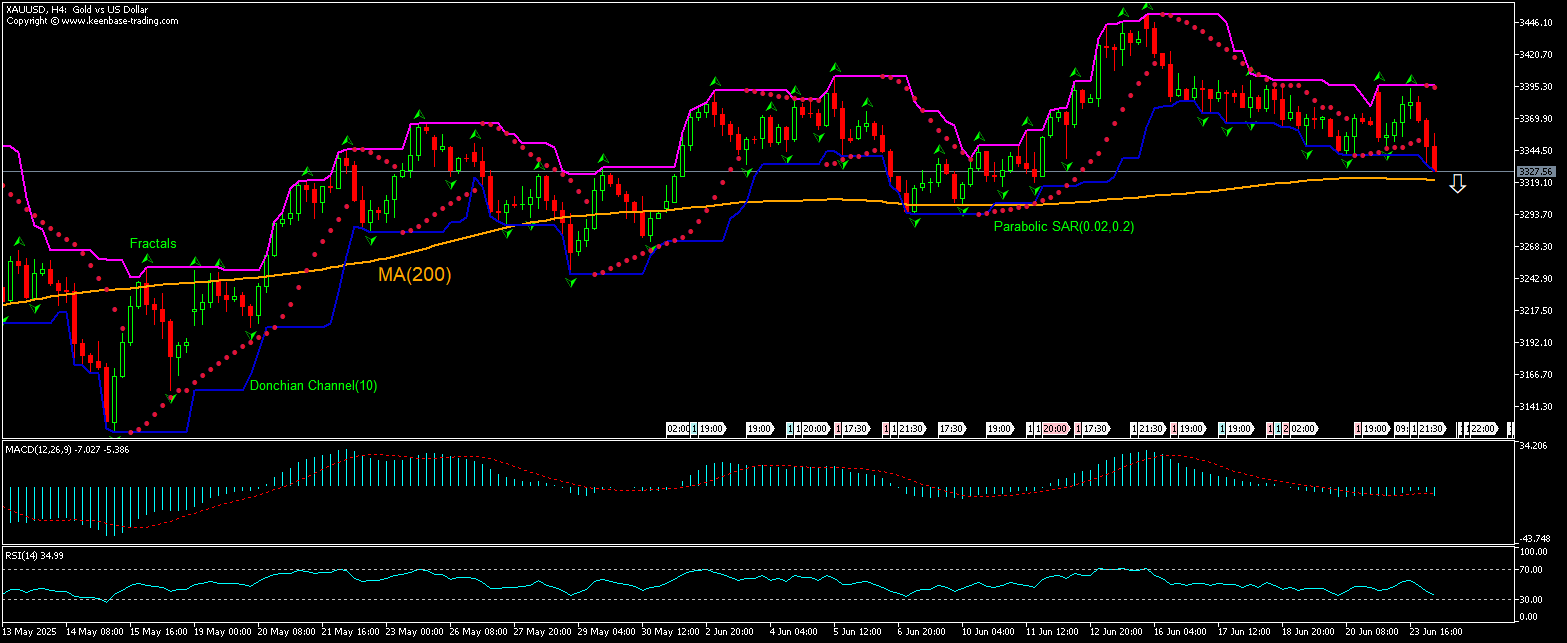

黃金 技術分析 - 黃金 交易: 2025-06-24

黃金 技術分析總結

低於 3325.23

Sell Stop

高於 3391.78

Stop Loss

| 指標 | 信號 |

| RSI | 中和 |

| MACD | 賣出 |

| Donchian Channel | 賣出 |

| MA(200) | 買進 |

| Fractals | 中和 |

| Parabolic SAR | 賣出 |

黃金 圖表分析

黃金 技術分析

对 XAUUSD 价格在 1 小时时间框架上的技术分析显示,XAUUSD,H1 正在测试 200 期均线 MA(200),因为它在八天前触及两周高点后正在回调。 我们认为,在价格跌破唐氏下边界 3325.23 点后,看跌势头将持续。该价位可作为挂单卖出的入场点。止损可设在 3391.78 以上。下达挂单后,根据抛物线信号,每天将止损移至下一个分形高点指标。因此,我们将预期盈亏比改为盈亏平衡点。如果价格达到止损位 (3391.78),但未达到订单位 (3325.23),我们建议取消订单:市场持续发生内部变化,而这些变化未被考虑在内。

貴金屬 基本面分析 - 黃金

伊朗对美国在卡塔尔的空军基地发动导弹袭击后,金价正在回落。XAUUSD 的回撤还会继续吗?

在美国对伊朗核设施进行空袭后,伊朗以导弹袭击美国在卡塔尔的空军基地作为回应。通常在地缘政治不确定性加剧的时期,对避险贵金属的需求会上升,因为投资者会增持黄金,因为这种避险资产能够保值。目前,黄金价格一直难以维持在每盎司 3,400 美元以上,处于横盘模式。不过,各大投资银行仍然看好这种避险贵金属。尤其是瑞银(UBS)仍然看涨黄金,维持每盎司 3800 美元的上涨目标。银行看涨黄金的情绪给 XAUUSD 价格带来了上行风险。

附注:

本文針對宣傳和教育, 是免費讀物. 文中所包含的資訊來自於公共管道. 不保障資訊的完整性和準確性. 部分文章不會更新. 所有的資訊, 包括觀點, 指數, 圖表等等僅用於介紹, 不能用於財務意見和建議. 所有的文字以及圖表不能作為交易的建議. IFC Markets及員工在任何情況下不會對讀者在閱讀文章中或之後採取的行為負責.