- 分析

- 技術分析

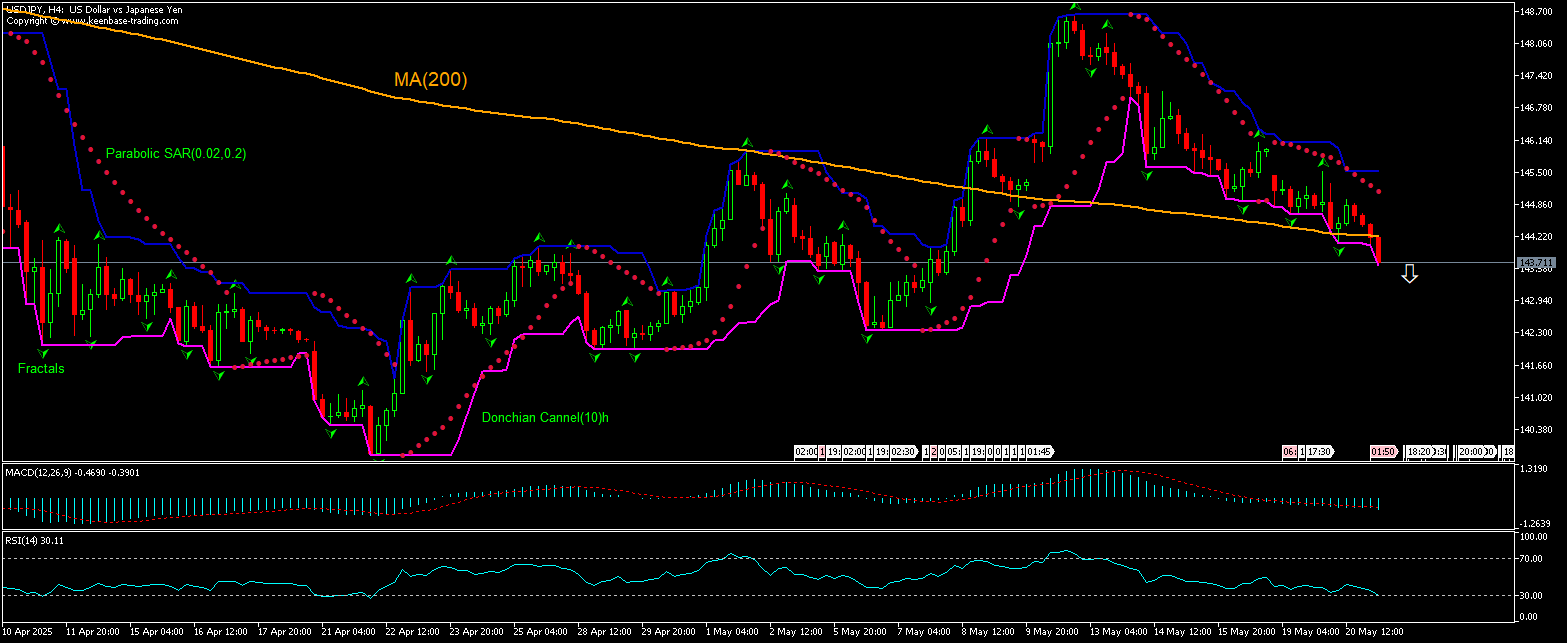

USD/JPY 技術分析 - USD/JPY 交易: 2025-05-21

USD/JPY 技術分析總結

低於 143.23

Sell Stop

高於 145.12

Stop Loss

| 指標 | 信號 |

| RSI | 買進 |

| MACD | 賣出 |

| Donchian Channel | 賣出 |

| MA(200) | 買進 |

| Fractals | 賣出 |

| Parabolic SAR | 賣出 |

USD/JPY 圖表分析

USD/JPY 技術分析

美元兑日元 4 小时价格图表的技术分析显示,美元兑日元 H4 在九天前触及六周高点后回落,已跌破 200 期移动均线 MA(200)。RSI 指标即将突破至超卖区域。 我们认为,在价格跌破唐氏通道下限 143.23 点后,看跌势头将持续。可将低于该价位作为挂单卖出的入场点。止损可设在 145.12 以上。下单后,根据抛物线信号,将止损移至下一个 分形高点指标。这样,我们就将预期盈亏比改为盈亏平衡点。如果价格达到止损位,但未达到订单,我们建议取消订单:市场发生了内部变化,而这些变化并未考虑在内。

外匯交易 基本面分析 - USD/JPY

日本 4 月份的贸易赤字有所收窄。USDJPY的价格回落还会继续吗?

日本贸易赤字收窄:日本财务省报告称,4 月份贸易赤字从 3 月份的 5,046.9 亿日元收窄至 1,1158.5 亿日元,预计盈余将回升至 2,711 亿日元。日本 4 月份出口同比增长 2%,与预测一致。这是日本连续第七个月实现出口增长,尽管在美国征收关税后的这一时期内增速最慢。由于对汽车、钢铁和船舶的需求下降,对美国的出货量下降了 1.8%,这是四个月来的首次下降。与此同时,日本进口总额同比下降 2.2%,但低于预期的下降 4.5%。日本贸易逆差收窄对日元利好,对美元兑日元利空。同时,数据显示今年第一季度日本实际国内生产总值年化萎缩率为 0.7%,这对美元兑日元来说是看涨。

附注:

本文針對宣傳和教育, 是免費讀物. 文中所包含的資訊來自於公共管道. 不保障資訊的完整性和準確性. 部分文章不會更新. 所有的資訊, 包括觀點, 指數, 圖表等等僅用於介紹, 不能用於財務意見和建議. 所有的文字以及圖表不能作為交易的建議. IFC Markets及員工在任何情況下不會對讀者在閱讀文章中或之後採取的行為負責.