- 分析

- 技術分析

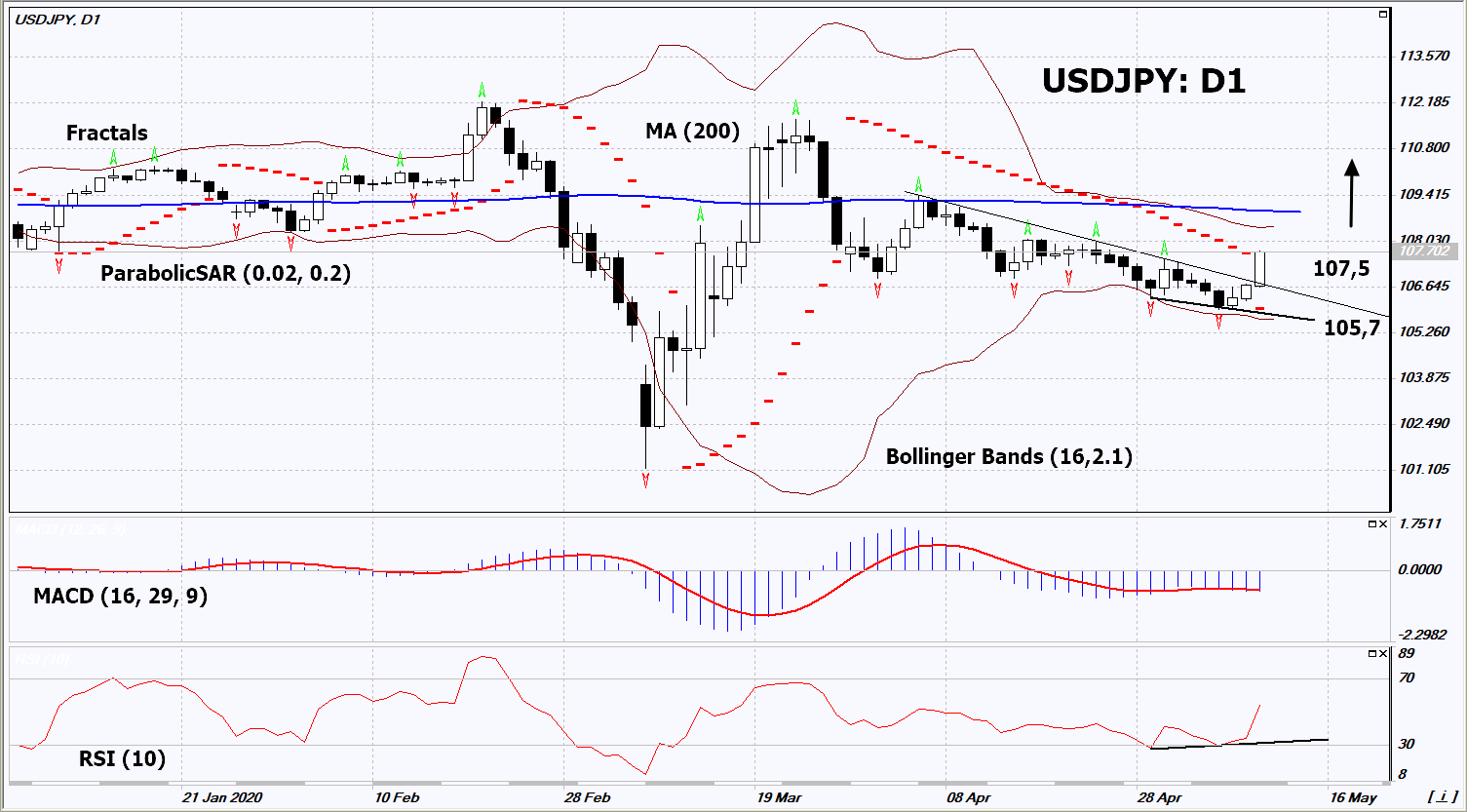

USD/JPY 技術分析 - USD/JPY 交易: 2020-05-12

USD/JPY 技術分析總結

高於 107.5

Buy Stop

低於 105.7

Stop Loss

| 指標 | 信號 |

| RSI | 買進 |

| MACD | 中和 |

| MA(200) | 中和 |

| Fractals | 買進 |

| Parabolic SAR | 買進 |

| Bollinger Bands | 買進 |

USD/JPY 圖表分析

USD/JPY 技術分析

On the daily timeframe, USDJPY: D1 breached up the resistance line of the short-term downtrend. A number of indicators of technical analysis formed signals for a further increase. We do not exclude a bullish movement if USDJPY rises above its last maximum: 107.5. This level can be used as an entry point. We can set a stop loss below the Parabolic signal, the last lower fractal and the lower Bollinger line: 105.7. After opening the pending order, we move the stop loss after the Bollinger and Parabolic signals to the next fractal minimum. Thus, we change the potential profit / loss ratio in our favor. After the transaction, the most risk-averse traders can switch to a four-hour chart and set a stop loss, moving it in the direction of the trend. If the price meets the stop level (105.7) without activating the order (107.5), it is recommended to delete the order: some internal changes in the market have not been taken into account.

外匯交易 基本面分析 - USD/JPY

April data on the US labor market were better than expected. This contributed to an increase in the dollar index. Will USDJPY quotes grow?

The upward movement means the weakening of the Japanese yen against the US dollar. The yen is included in the dollar index. Previously, the Japanese currency, along with the Swiss franc and gold, was in demand as a protective asset against the backdrop of global risks due to the Covid-19 pandemic. Several countries (France, Japan, New Zealand, Britain, and others) reported a decrease in the number of patients and the mitigation of quarantine measures. The US dollar is in good demand due to positive unemployment data for April and Non Farm Payrolls. They were better than expected. At the same time, the Japanese economic indicator Jibun Bank Composite PMI for April was worse than expected. This week important economic indicators such as Consumer Price, Retail Sales and Industrial Production will be published in the US. In Japan, Eco Watchers Survey, Machine Tool Orders, and Current Account will be released. All of this may affect the dynamics of USDJPY. On Wednesday, Jerome Powell, the head of the United States Federal Reserve, will give a speech. On Monday, the head of the Chicago Federal Reserve Bank (Chicago FRB) Charles Evans said that he does not expect negative Fed rates and a noticeable increase in inflation. Note that according to the American Commodity Futures Trading Commission (CFTC), demand for US dollars (net long) has been growing for the 7th week in a row and peaked in 2 months.

附注:

本文針對宣傳和教育, 是免費讀物. 文中所包含的資訊來自於公共管道. 不保障資訊的完整性和準確性. 部分文章不會更新. 所有的資訊, 包括觀點, 指數, 圖表等等僅用於介紹, 不能用於財務意見和建議. 所有的文字以及圖表不能作為交易的建議. IFC Markets及員工在任何情況下不會對讀者在閱讀文章中或之後採取的行為負責.