- 分析

- 技術分析

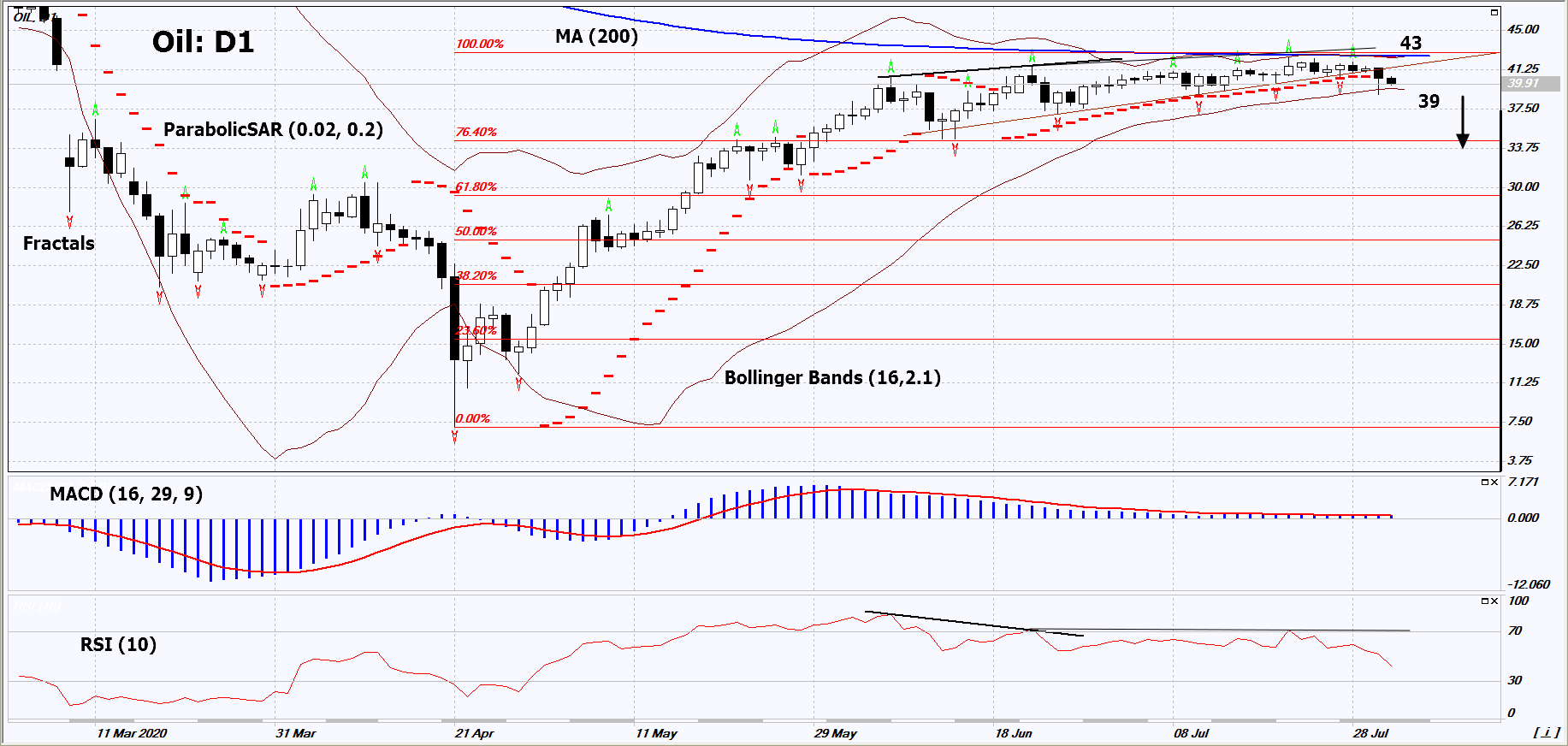

原油 WTI 技術分析 - 原油 WTI 交易: 2020-08-03

WTI原油 技術分析總結

低於 39

Sell Stop

高於 43

Stop Loss

| 指標 | 信號 |

| RSI | 賣出 |

| MACD | 中和 |

| MA(200) | 中和 |

| Fractals | 中和 |

| Parabolic SAR | 賣出 |

| Bollinger Bands | 中和 |

WTI原油 圖表分析

WTI原油 技術分析

On the daily timeframe, Oil: D1 is being traded in a narrow neutral range for almost 2 months. A number of technical analysis indicators formed signals for a decline. We do not rule out a bearish movement if Oil falls below the lower Bollinger band: 39. This level can be used as an entry point. We can set a stop loss above the last two upper fractals, the upper Bollinger line, the 200-day moving average line and the Parabolic signal: 43. After opening a pending order, we should move the stop loss following the Bollinger and Parabolic signals to the next fractal low. Thus, we change the potential profit/loss ratio in our favor. The most risk-averse traders, after the transaction, can switch to a four-hour chart and set a stop loss, moving it in the direction of the bias. If the price meets the stop loss (43) without activating the order (39), it is recommended to delete the order: some internal changes in the market have not been taken into account.

商品 基本面分析 - WTI原油

Since August 1, 2020, OPEC + countries will increase oil production by 1.5 million barrels per day (bpd). Will oil quotes go down ?

On July 15, 2020, the OPEC + countries agreed to reduce the oil production limit from 9.7 million bpd to 7.7 million bpd from August 1. This means that the difference (or 2 million bpd) will additionally enter the world market. The real increase will be less, and will amount to 1.5 million bpd, as a number of countries such as Iraq and Nigeria have exceeded their oil production quotas in the past. In May, the overall OPEC + reduction quota was met by only 87%, bringing additional 1.26 million barrels per day to the world market. This did not prevent the growth in oil quotes. In June, the quota was met by 107%. The next increase in production, by another 2 million bpd, is expected only in early 2021, when the OPEC + production limit will be reduced to 5.7 million bpd. The continuation of the coronavirus pandemic may be another negative factor for oil prices. A number of countries are inclined to reintroduce quarantine, which will lead to lower demand.

附注:

本文針對宣傳和教育, 是免費讀物. 文中所包含的資訊來自於公共管道. 不保障資訊的完整性和準確性. 部分文章不會更新. 所有的資訊, 包括觀點, 指數, 圖表等等僅用於介紹, 不能用於財務意見和建議. 所有的文字以及圖表不能作為交易的建議. IFC Markets及員工在任何情況下不會對讀者在閱讀文章中或之後採取的行為負責.