- 分析

- 技術分析

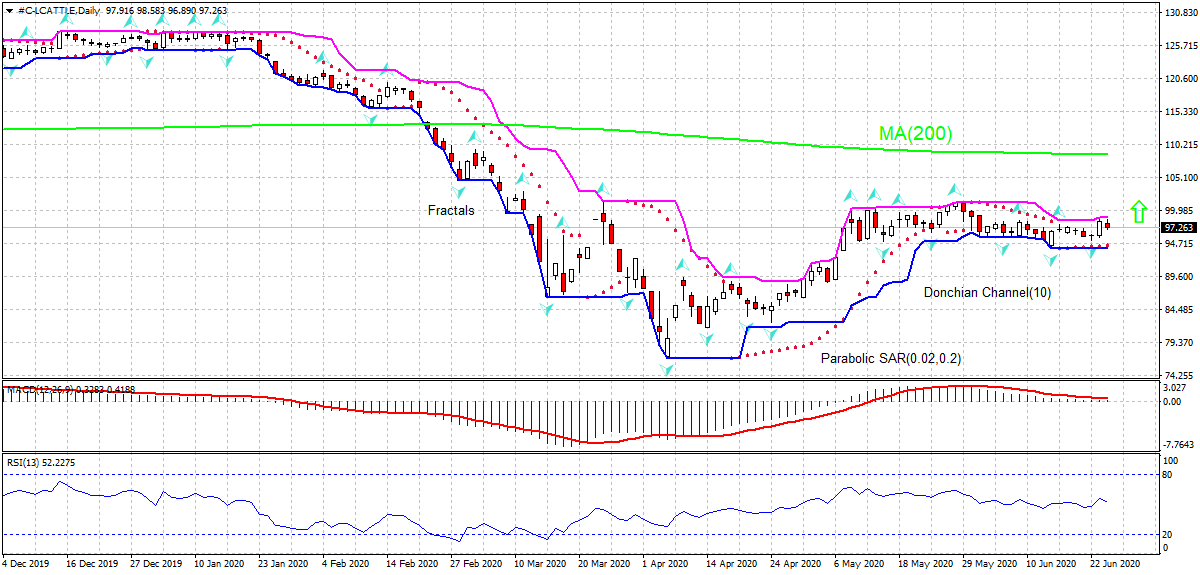

活牛 技術分析 - 活牛 交易: 2020-06-25

活牛 技術分析總結

高於 98.78

Buy Stop

低於 94.06

Stop Loss

| 指標 | 信號 |

| RSI | 中和 |

| MACD | 中和 |

| Donchian Channel | 中和 |

| MA(200) | 賣出 |

| Fractals | 買進 |

| Parabolic SAR | 買進 |

活牛 圖表分析

活牛 技術分析

On the daily timeframe #C-LCATTLE: D1 is retracing toward the 200-day moving average MA(200), which has leveled off. We believe the bullish momentum will continue after the price breaches above the upper Donchian boundary at 98.78. This level can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 94.06. After placing the pending order the stop loss is to be moved every day to the next fractal low, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop-loss level (94.06) without reaching the order (98.78) we recommend cancelling the order: the market sustains internal changes that were not taken into account.

商品 基本面分析 - 活牛

USDA reported a drop in frozen US beef inventory. Will the lcattle resume rising?

US frozen beef supplies suffered a steep drop last month according to the US Department of Agriculture National Agricultural Statistics Service (NASS) monthly report released a couple of days ago. The total amount of beef in freezers was recorded at 415.221 million pounds, down 64.235 million, or 13.4%, from 479.456 million the previous month. Lower supply is bullish for the live cattle price. However, US cattle ranchers experience a massive backlog even as many slaughterhouses come back online with meat production recovering after a drop because of shutdowns of slaughterhouses and processing plants due to coronavirus outbreak. Thus, processors killed an estimated 119,000 cattle last Friday, up from 115,000 cattle a week earlier. Increasing production is a downside risk for the live cattle price.

附注:

本文針對宣傳和教育, 是免費讀物. 文中所包含的資訊來自於公共管道. 不保障資訊的完整性和準確性. 部分文章不會更新. 所有的資訊, 包括觀點, 指數, 圖表等等僅用於介紹, 不能用於財務意見和建議. 所有的文字以及圖表不能作為交易的建議. IFC Markets及員工在任何情況下不會對讀者在閱讀文章中或之後採取的行為負責.