- 分析

- 技術分析

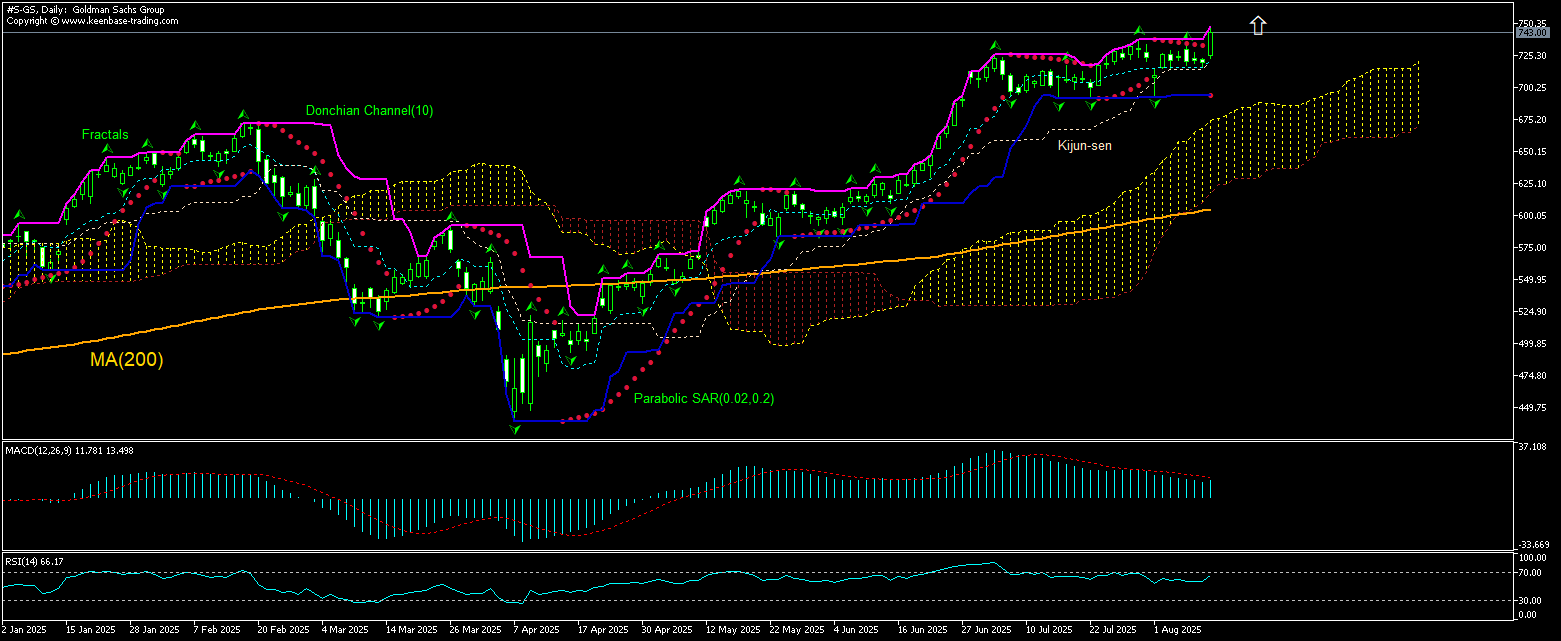

Goldman Sachs 技術分析 - Goldman Sachs 交易: 2025-08-13

Goldman Sachs 技術分析總結

高於 747.83

Buy Stop

低於 693.95

Stop Loss

| 指標 | 信號 |

| RSI | 中和 |

| MACD | 買進 |

| Donchian Channel | 買進 |

| MA(200) | 買進 |

| Fractals | 中和 |

| Parabolic SAR | 買進 |

| Ichimoku Kinko Hyo | 買進 |

Goldman Sachs 圖表分析

Goldman Sachs 技術分析

The technical analysis of the Goldman Sachs stock price chart on daily timeframe shows #S-GS, Daily is advancing above the 200-day moving average MA(200) after returning above MA(200) 8 weeks ago. We believe the bullish momentum will continue after the price breaches above the upper boundary of Donchian channel at 747.83. This level can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 693.95. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (693.95) without reaching the order (747.83), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

股票 基本面分析 - Goldman Sachs

Goldman Sachs stock rose after the bank said it is raising its dividend. Will the Goldman Sachs stock price continue advancing?

The Goldman Sachs Group, Inc. is a global investment bank and financial services company with market capitalization at $225.0 billion. The company is active in four primary segments: Global Banking & Markets, Asset & Wealth Management, and Platform Solutions. The stock is trading at P/E ratio (Trailing Twelve Months) of 16.37 and Price/Sales ratio of 4.31 currently. The company earned $54.79 billion revenue (ttm), operated at Operating Margin (ttm) of 35.73% and earned a Return on Equity (ttm) of 12.74% . The bank announced it will increase its dividend from last year's comparable payment on the 29th of September to $4.00. This takes the annual payment to 2.2% of the current stock price, which is about average for the industry. The bank's distributions have been remarkably stable over its long history of paying dividends. The dividend has gone from an annual total of $2.40 in 2015 to the most recent total annual payment of $16.00. This means that it has been growing its distributions at 21% per annum over that time. There has been strong dividend growth and there haven't been any cuts for a long time. With earnings growing rapidly and a low payout ratio the company is a great dividend stock. One has just to take into account that the dividend payment sustainability is not 100 guaranteed since while Goldman Sachs has a low payout ratio the bank’s free cash flows weren't positive based on the last payment. The increase in Goldman Sachs’ dividend is bullish for Goldman Sachs stock price.

附注:

本文針對宣傳和教育, 是免費讀物. 文中所包含的資訊來自於公共管道. 不保障資訊的完整性和準確性. 部分文章不會更新. 所有的資訊, 包括觀點, 指數, 圖表等等僅用於介紹, 不能用於財務意見和建議. 所有的文字以及圖表不能作為交易的建議. IFC Markets及員工在任何情況下不會對讀者在閱讀文章中或之後採取的行為負責.