- 分析

- 技術分析

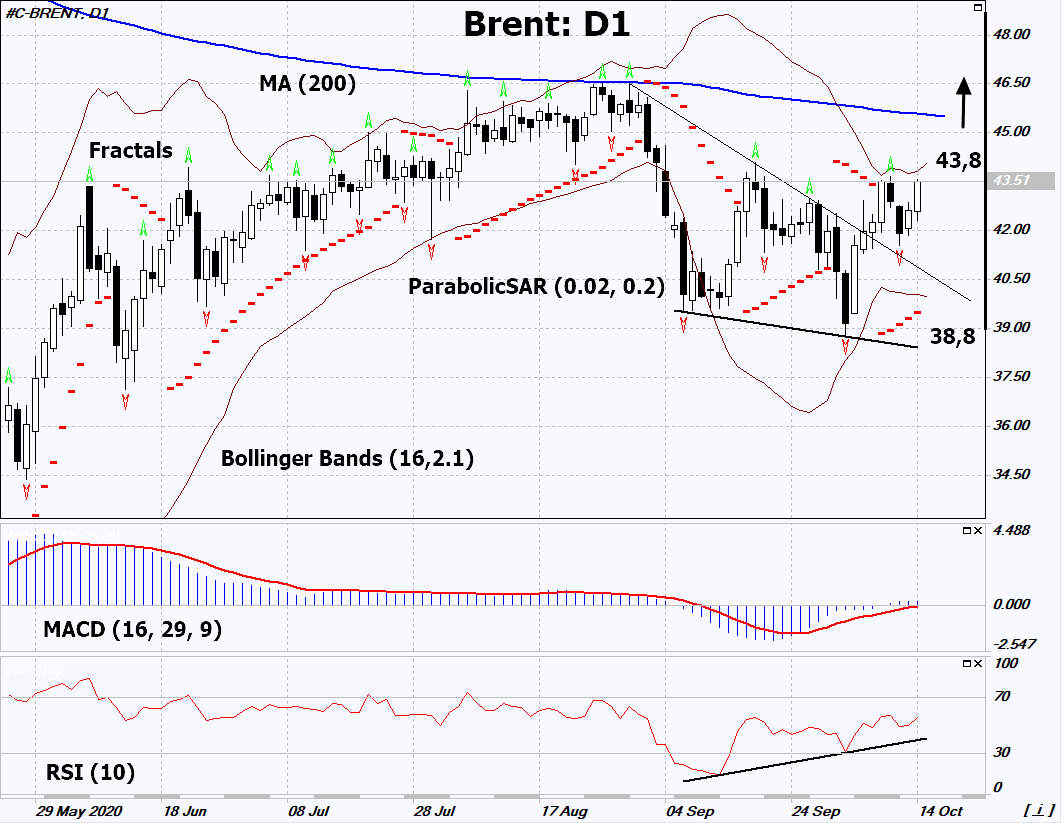

布蘭特原油 技術分析 - 布蘭特原油 交易: 2020-10-15

布 蘭 特 原油 技術分析總結

高於 43,8

Buy Stop

低於 38,8

Stop Loss

| 指標 | 信號 |

| RSI | 買進 |

| MACD | 買進 |

| Parabolic SAR | 買進 |

| MA(200) | 中和 |

| Fractals | 中和 |

| Bollinger Bands | 中和 |

布 蘭 特 原油 圖表分析

布 蘭 特 原油 技術分析

On the daily timeframe, Brent: D1 has exceeded the resistance line of the short-term downtrend. It is trying to continue the upward trend, but is currently traded in a narrow range. A number of technical analysis indicators formed signals for further growth. We do not exclude a bullish movement if Brent rises above the last upper fractal: 43.8. This level can be used as an entry point. We can place a stop loss below the Parabolic signal, the last 2 lower fractals and the lower Bollinger line: 38.8. After opening a pending order, we move the stop loss to the next fractal low following the Bollinger and Parabolic signals. Thus, we change the potential profit/loss ratio in our favor. After the transaction, the most risk-averse traders can switch to the four-hour chart and set a stop-loss, moving it in the direction of movement. If the price meets the stop loss (38.8) without activating the order (43.8), it is recommended to delete the order: market sustains some internal changes not taken into account.

商品 基本面分析 - 布 蘭 特 原油

The leaders of Saudi Arabia and Russia held negotiations on the regulation of the oil market. Will the Brent quotes grow?

Crown Prince of Saudi Arabia Mohammed bin Salman and Russian President Vladimir Putin agreed to adhere to the current restrictions on oil production and call on other OPEC + members to do so. They also agreed to apply concerted action to further restrict production should oil demand fall. This can reduce the risks of oil prices drop if the 2nd wave of the coronavirus pandemic spreads. Earlier, world oil prices rose due to increased demand from China. In September 2020, China imported 11.8 million barrels per day. This is 5.5% more than in August this year and 17.5% more than in September 2019. The International Energy Agency noted that the oil supply in the world market in September 2020 was 9% less than last year. OPEC predicts an increase in global oil demand by 6.56 million barrels per day to 96.84 million in 2021. That's 0.2% less than its previous estimate of demand. In theory, a slow recovery in global demand could delay OPEC's oil production ramp-up.

附注:

本文針對宣傳和教育, 是免費讀物. 文中所包含的資訊來自於公共管道. 不保障資訊的完整性和準確性. 部分文章不會更新. 所有的資訊, 包括觀點, 指數, 圖表等等僅用於介紹, 不能用於財務意見和建議. 所有的文字以及圖表不能作為交易的建議. IFC Markets及員工在任何情況下不會對讀者在閱讀文章中或之後採取的行為負責.