- 分析

- 技術分析

糖 技術分析 - 糖 交易: 2016-05-20

Dry weather expected to boost sugar prices

Sugar prices rose on upward revised estimates of global supply shortage due to lower cane crop in Asia because of El Nino induced drought. At the same time sugar output in Brazil is higher as the cane crushing season began in country’s Centre South region. Will the price of sugar continue rising?

Sugar futures prices have been rising recently on several analyst projections of growing global deficit. On Monday market analyst Platts Kingsman increased by 20% its estimate for the 2016-17 deficit to 7.67m tonnes. On Wednesday an Australian consultancy Green Pool revised upward to 6.5m tonnes from 4.95m tonnes its forecast for the shortfall in world sugar output from demand in 2016-17. The lower output is expected due to lower Asian cane crops because of dry weather caused by El Nino. India is expected to become a net sugar importer of 850000 tonnes next season as El Nino may hinder cane planting, resulting in 2016-17 output drop by 900,000 tonnes to 23.4m tonnes. Global deficit estimates were increased even after world’s top sugar producer Brazil reported the sugar output from Center South region, accounting for 90% of country’s production, was up 71% year on year at 1.81m tonnes. The commitment of traders report released last Friday by the US Commodity Futures trading Commission showed speculators had increased their net long position in the sugar market by 19550 contracts to 193340 contracts the previous week. The new report will be released today, and a further build in net longs will confirm managed money is positioning for a further rise in sugar prices.

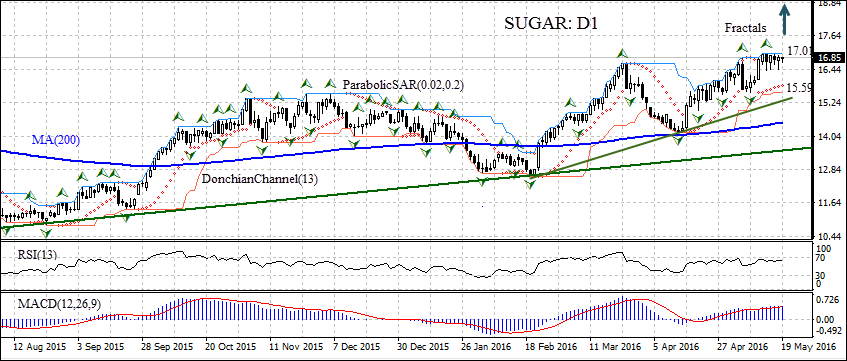

On the daily timeframe SUGAR: D1 has been rising since August last year. In the recent rally which started in mid-April the price bounced off the 200-day moving average MA(200) and rose by over 19% from the low of 14.21 cents per pound. It is currently consolidating after hitting a 21-month high last Friday. The Parabolic indicator has formed a buy signal. The Donchian channel is tilted upward, indicating an uptrend. The RSI oscillator is edging toward the overbought zone but hasn’t crossed it yet. The MACD indicator is above the signal line and the zero level, which is also a bullish signal. We believe the uptrend will continue after the price closes above the last fractal high and the upper boundary of the Donchian channel at 17.01. It can be used as an entry point for setting a pending buy order. The stop loss can be placed below last fractal low at 15.59, which is confirmed also by the lower Donchian channel. After placing the order, the stop loss is to be moved to the next fractal low following Parabolic signals. If the price meets the stop loss level at 15.59 without reaching the order at 17.01, we recommend cancelling the position: the market sustains internal changes which were not taken into account.

| Position | Buy |

| Buy stop | above 17.01 |

| Stop loss | below 15.59 |

附注:

本文針對宣傳和教育, 是免費讀物. 文中所包含的資訊來自於公共管道. 不保障資訊的完整性和準確性. 部分文章不會更新. 所有的資訊, 包括觀點, 指數, 圖表等等僅用於介紹, 不能用於財務意見和建議. 所有的文字以及圖表不能作為交易的建議. IFC Markets及員工在任何情況下不會對讀者在閱讀文章中或之後採取的行為負責.