- 分析

- 技術分析

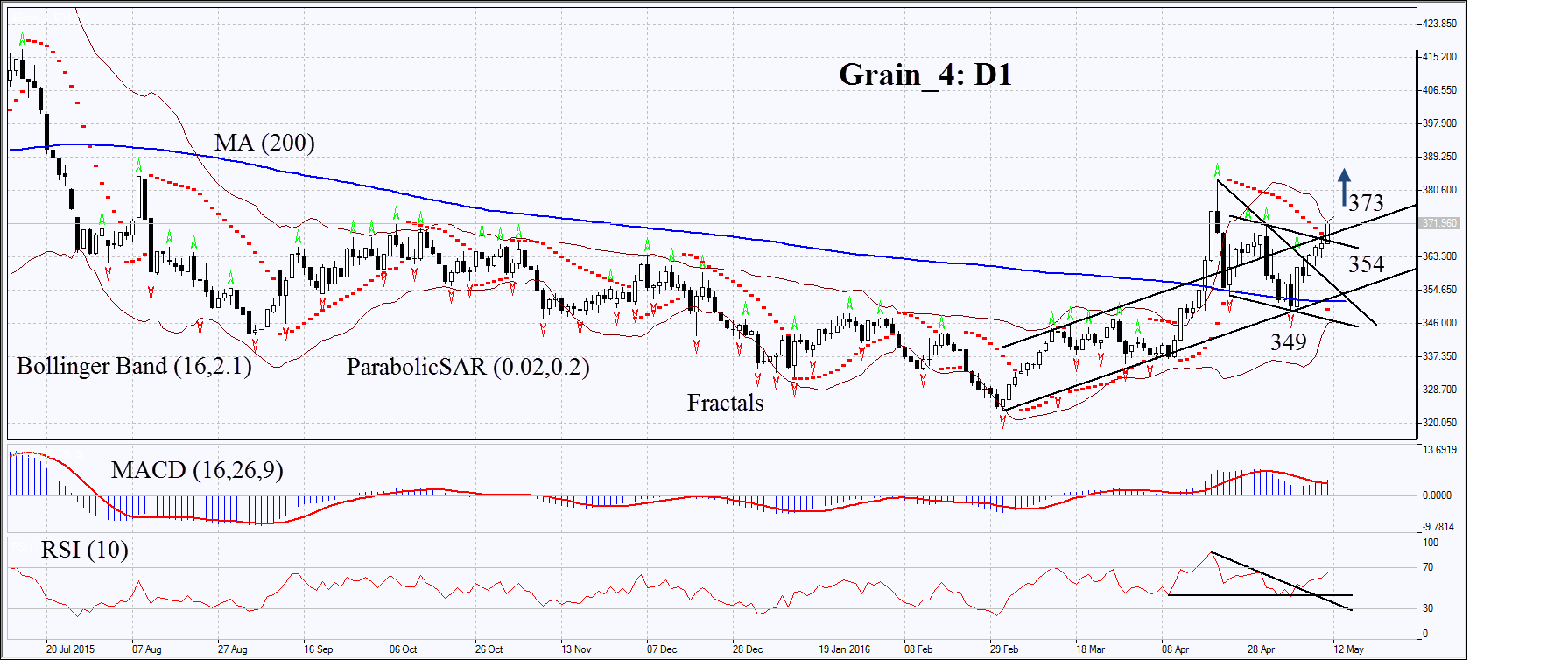

穀物指數 技術分析 - 穀物指數 交易: 2016-05-18

Weather may affect grains

Personal composite instrument Grain_4, that is a grains index in fact, has left the downtrend to move upwards. The main reason for that was the drought in Asian and Latin American countries which may hurt crops. By the way, poor weather conditions are observed in Europe as well. Germany expects the wheat crops to fall in 2016 by 3.7% to 25.57mln tonnes. Will the grains index continue edging up?

Most market participants believe the grains price increase is speculative. The most important quarterly report on the US grains stockpiles from USDA is to be released only on June 30 while the monthly global grains market report is due on June 10. Ahead of reports, the grains prices are most likely to be guided by weather forecasts.

On the daily chart Grain_4: D1 failed to break down through the 200-day moving average line and left the downtrend to correct upwards. MACD and Parabolic indicators give signals to buy. RSI has formed weak positive divergence and has not yet reached the overbought zone. The Bollinger bands have started widening which means higher volatility. They are tilted upwards. The bullish momentum may develop in case the grains index surpasses the three last fractal highs and the Bollinger band at 373. This level may serve the point of entry. The initial stop loss may be placed below the mid-term support line at 354 now or at fractal low at 349. Having opened the pending order we shall move the stop to the next fractal low following the Parabolic and Bollinger signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. The most risk-averse traders may switch to the 4-hour chart after the trade and place there a stop-loss moving it in the direction of the trade. If the price meets the stop-loss level at 354 or 349 without reaching the order at 373, we recommend cancelling the position: the market sustains internal changes which were not taken into account.

| Position | Buy |

| Buy stop | above 373 |

| Stop loss | below 354 or 349 |

附注:

本文針對宣傳和教育, 是免費讀物. 文中所包含的資訊來自於公共管道. 不保障資訊的完整性和準確性. 部分文章不會更新. 所有的資訊, 包括觀點, 指數, 圖表等等僅用於介紹, 不能用於財務意見和建議. 所有的文字以及圖表不能作為交易的建議. IFC Markets及員工在任何情況下不會對讀者在閱讀文章中或之後採取的行為負責.