- 分析

- 市場情緒

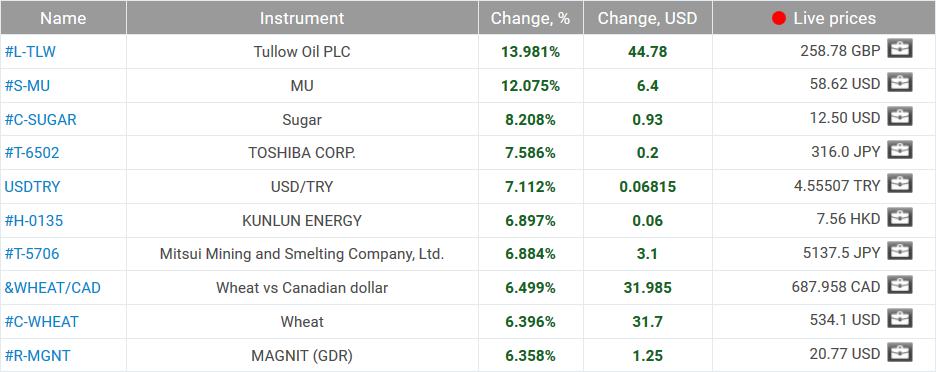

WEEKLY TOP GAINERS/LOSERS: 23.05.2018

Top Gainers – The World Market

Top Gainers – The World Market

1. Tullow Oil – – stock prices of the company rose together with world oil prices. The investment bank Morgan Stanley raised forecasts of Tullow Oil’s financial performance. On Wednesday, its stock prices fell. The new president of Peru has canceled several oil production contracts of this company on the Peruvian shelf.

2. Micron Technology – stock prices of the memory card manufacturer have been rising since the beginning of May due to good earnings reports for the 1st quarter of 2018. The noticeable growth over the week was caused by the company's plans to buy back its own stocks for $10 billion. Another positive factor was the success in developing a new technology 3D NAND.

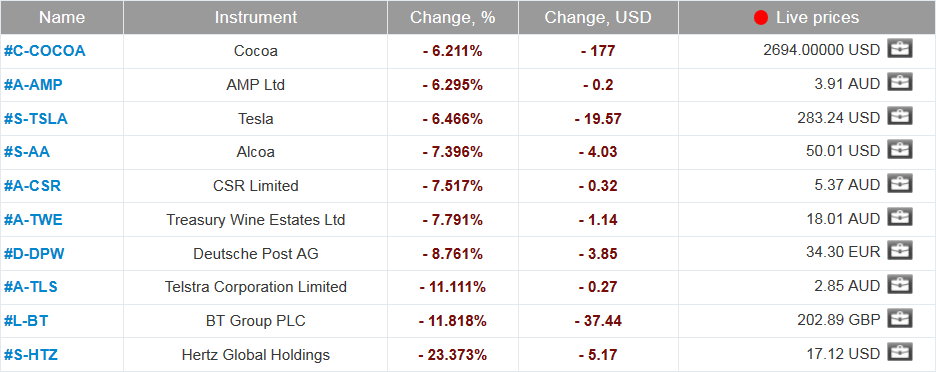

Top Losers – The World Market

Top Losers – The World Market

1. Tesla Motors – stock prices of the company fell after the authoritative magazine “Consumer Reports” reported issues in the braking control system of the new electric vehicle Model 3.

2. Ausnet Services – stock prices of the Australian energy company are falling after the publication of earnings reports for the fiscal year ending on March 31, 2018 and decisions on payments to shareholders. Profits per stock increased by 14%, and the expected dividends - only by 5%.

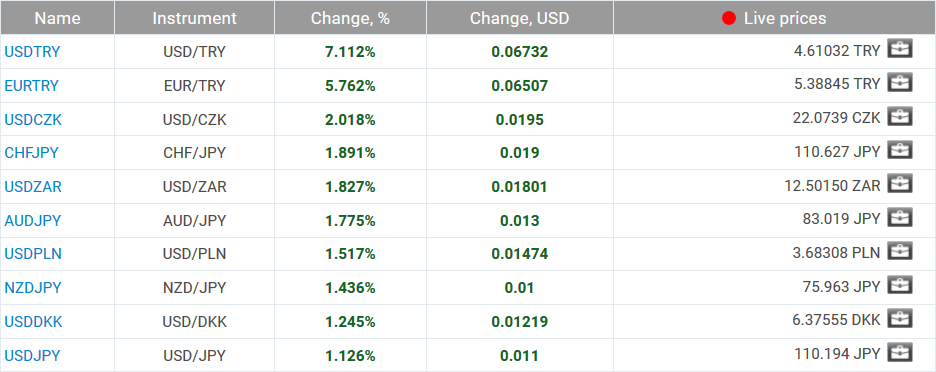

Top Gainers – Foreign Exchange Market (Forex)

Top Gainers – Foreign Exchange Market (Forex)

1. USDTRY, EURTRY - The Turkish lira has been falling against the US dollar and the euro for the 4th consecutive week. On the chart it looks like a growth. On June 24, 2018, early presidential and parliamentary elections will be held in Turkey. Current President Tayyip Erdogan stands for strengthening control over the economy. Investors were afraid of lower rates. With the aim to support the exchange rate, the Central Bank of Turkey raised the rate to 16.5% on May 23. It is possible that the weakening of the lira will cease, since inflation in the country is much lower. In May, it was 10.85% year over year.

2. USDCZK - the Czech koruna collapsed amid the strengthening of the US dollar. On the chart it looks like a growth. In addition, statements of the representatives of the Czech National Bank that the Czech economy is experiencing strong inflationary pressures had a negative impact. This reduces the likelihood of an early rate hike. Let us recall that at the regular meeting on May 3, the Czech Central Bank kept the rate at 0.75%, while the majority of market participants expected its growth by 0.25%.

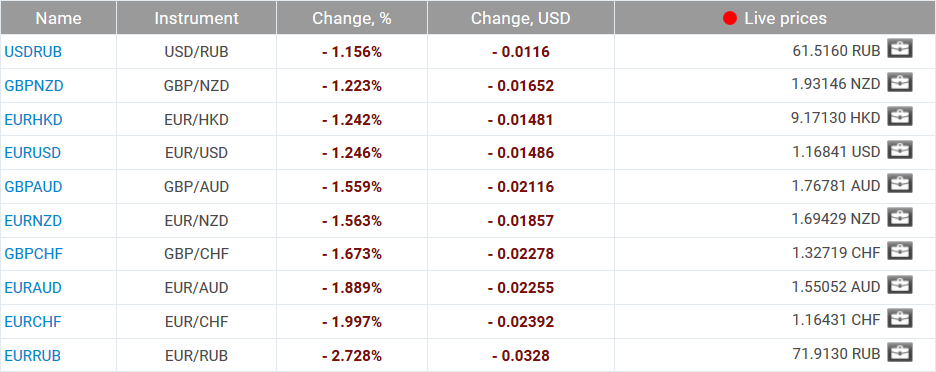

Top Losers - Foreign Exchange Market (Forex)

Top Losers - Foreign Exchange Market (Forex)

1. USDRUB - the Russian ruble strengthened against the US dollar amid high world oil prices. The share of energy raw materials in Russian exports is 65%.

2. GBPNZD - The New Zealand dollar strengthened due to an increase in the government forecast of the budget surplus for the current fiscal year to NZ $3.14 billion. However, on Wednesday, it again fell after the report by the Reserve Bank of New Zealand on the beginning of the money emission and the launch of the quantitative easing program. In turn, the British pound showed the highest daily decline in 2018 after the publication of data on the decrease in inflation in April. Now investors doubt that the Bank of England will raise rates in the foreseeable future.

附注:

本文針對宣傳和教育, 是免費讀物. 文中所包含的資訊來自於公共管道. 不保障資訊的完整性和準確性. 部分文章不會更新. 所有的資訊, 包括觀點, 指數, 圖表等等僅用於介紹, 不能用於財務意見和建議. 所有的文字以及圖表不能作為交易的建議. IFC Markets及員工在任何情況下不會對讀者在閱讀文章中或之後採取的行為負責.

最新市場情緒

- 3月18領漲/跌者: 加元和日元

在過去的7天裡,石油,有色金屬和其他礦物原料的價格雖然有所下降,但仍保持在較高水準。因此,商品貨幣有所加強:加元,澳大利亞和紐西蘭元,墨西哥比索和南非蘭特。在公佈負面經濟資料之後,日元走弱:貿易平衡,工業生產及該行業一系列商業活動資料。此外,日元受到日本銀行行長黑田東彥講話的負面影響,即日本的通貨膨脹不太可能在2024年達到+...

- 3月10Weekly Top Gainers/Losers: Canadian dollar and New Zealand dollar

Оil quotes continued to rise over the past 7 days. Against this background, the currencies of oil-producing countries, such as the Russian ruble and the Canadian dollar, strengthened. The New Zealand dollar weakened after the announcement of negative economic indicators: ANZ Business Confidence and...

- 3月4領漲/跌者: 美元和南非蘭特

在過去的7天裡,石油價格持續上漲。 包括黃金在內的貴金屬價格下跌。 在這種背景下,石油公司的股票有所增加,俄羅斯盧布走強,澳大利亞和紐西蘭元以及南非蘭特走軟。 在美國政府債券收益率持續增長的推動下,美元走強。

...